Role of Fiduciary Advisers – Why Trust Matters Globally

- Dec 11, 2025

- 6 min read

Most people are surprised to learn that a single oversight in financial advice can cost clients far more than they expect. As the wealth management industry grows increasingly complex, both British and international investors need reliable guidance grounded in clear ethical standards. This article uncovers exactly what sets fiduciary advisers apart, highlighting why their strict legal duties and transparent practices matter for anyone seeking truly secure financial advice.

Table of Contents

Key Takeaways

Point | Details |

Fiduciary Advisers Prioritise Client Interests | Fiduciary advisers are legally bound to act in their clients’ best financial interests, ensuring transparency and ethical responsibility. |

Diverse Fiduciary Relationships Exist | Various types of fiduciary relationships serve distinct clients, including personal wealth management, institutional services, and investment advisory. |

Rigorous Legal Standards are Key | Global fiduciary regulations require rigorous adherence to disclosure, professional conduct, and ongoing compliance obligations. |

Conflict Mitigation is Essential | Advisers must proactively identify and disclose conflicts of interest, maintaining a clear focus on client welfare throughout all interactions. |

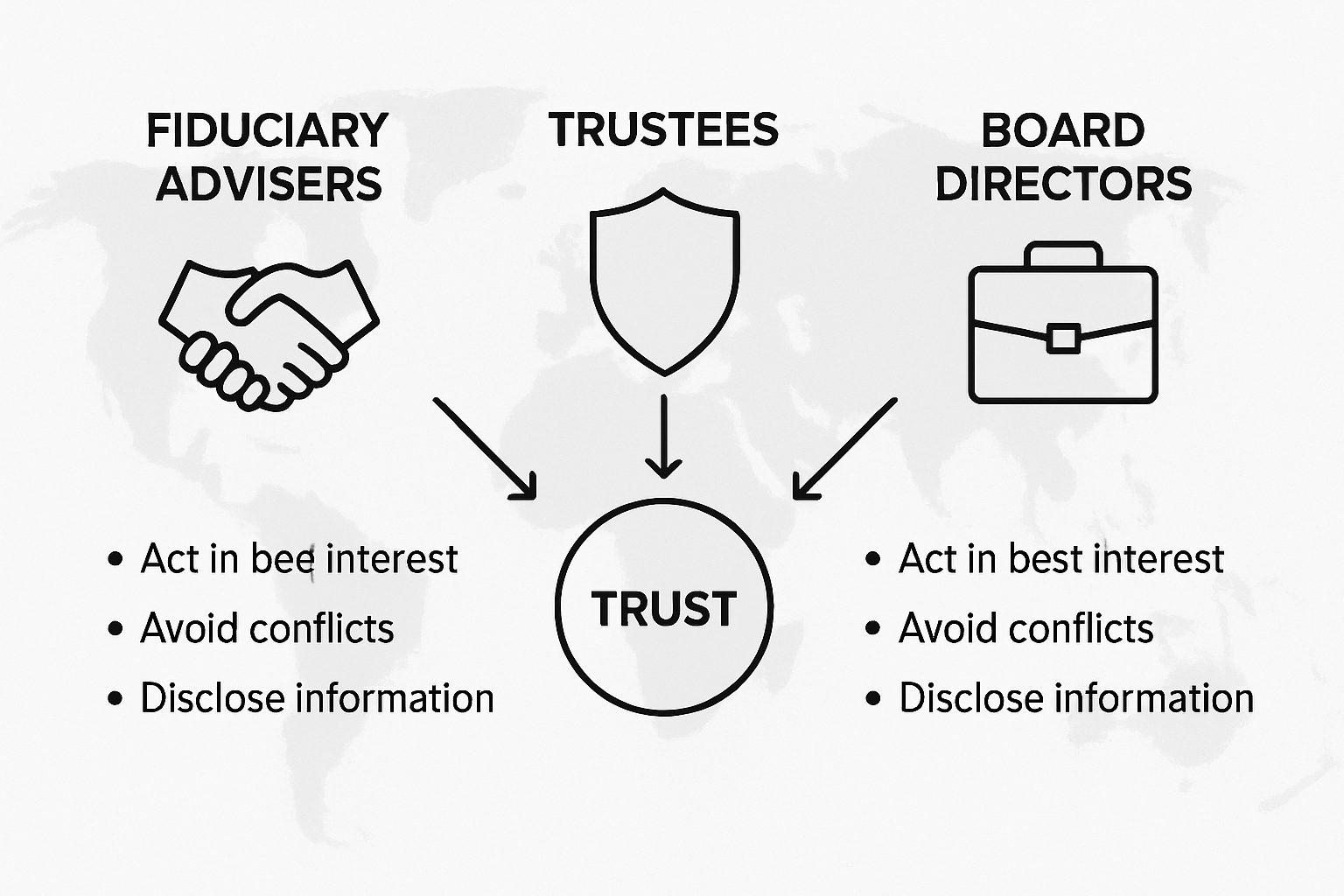

Defining Fiduciary Advisers and Their Duties

A fiduciary adviser represents a specialised category of financial professional bound by the highest legal and ethical standards in wealth management. Unlike standard financial consultants, these experts are legally obligated to prioritise their clients’ financial interests above their own personal gain. Comprehensive research from Forbes confirms that fiduciary advisers must operate with complete transparency and unwavering commitment to client welfare.

The fundamental responsibility of a fiduciary adviser centres on acting in the client’s best financial interests. This means recommending investment strategies, financial products, and planning approaches that genuinely benefit the client’s unique economic situation, rather than generating maximum commissions or personal profits. Their legal mandate requires them to disclose any potential conflicts of interest, provide comprehensive financial guidance, and maintain an exceptionally high standard of professional conduct.

Key characteristics that distinguish fiduciary advisers include:

Legal obligation to prioritise client interests

Complete transparency about compensation structures

Comprehensive disclosure of potential investment conflicts

Personalised financial strategy development

Ongoing commitment to client financial health

Clients seeking sophisticated, trustworthy financial guidance should specifically seek professionals who can demonstrate their fiduciary status. These advisers are not merely consultants but strategic partners dedicated to protecting and growing their clients’ financial resources with the utmost professional integrity.

Key Types of Fiduciary Relationships Worldwide

Financial fiduciary relationships encompass diverse professional interactions designed to protect clients’ financial interests across different sectors and contexts. Global financial adviser classifications reveal complex variations in professional roles, with each type serving unique client needs and operating under specific regulatory frameworks.

Three primary categories of fiduciary relationships dominate international financial landscapes:

Personal Wealth Management Fiduciaries

Manage individual and family assets

Often provided by private banks and trust companies

Focus on personalised wealth preservation and growth strategies

Institutional Fiduciary Services

Serve corporations, pension funds, and governmental entities

Manage large-scale investment portfolios

Operate under strict regulatory compliance protocols

Investment Advisory Fiduciaries

Personal fiduciary services typically include registered investment advisers (RIAs)

Charge fees based on assets under management

Legally obligated to prioritise client financial interests

Each fiduciary relationship type demands rigorous professional standards, comprehensive understanding of client objectives, and an unwavering commitment to ethical financial management. The global financial ecosystem relies on these nuanced professional relationships to ensure transparent, trustworthy wealth management practices that protect clients’ economic interests across various jurisdictions.

Legal Standards and Global Regulatory Framework

The landscape of fiduciary regulation represents a complex global tapestry of legal frameworks designed to protect investor interests and maintain financial system integrity. The Investment Advisers Act of 1940 stands as a pivotal milestone in establishing comprehensive regulatory standards, providing a blueprint for financial oversight that has influenced regulatory approaches worldwide.

Global regulatory frameworks typically encompass several critical dimensions of fiduciary responsibility:

Registration Requirements

Mandatory professional registration

Comprehensive background checks

Ongoing compliance monitoring

Disclosure Obligations

Full transparency of fee structures

Detailed reporting of potential conflicts of interest

Comprehensive client communication protocols

Professional Conduct Standards

Ethical investment recommendations

Prioritisation of client financial interests

Continuous professional development mandates

The international regulatory environment continues to evolve, with jurisdictions progressively adopting more stringent frameworks that demand higher levels of professional accountability. This global convergence reflects a shared commitment to protecting investors, reducing financial misconduct, and maintaining the fundamental trust that underpins sophisticated financial relationships. While specific regulations vary between countries, the core principles of transparency, integrity, and client-centric financial management remain universally paramount.

Responsibilities, Obligations, and Fee Structures

Fiduciary advisers carry profound responsibilities that extend far beyond typical financial consulting roles. Registered Investment Advisers exemplify the gold standard of professional financial guidance, with a legal mandate to prioritise clients’ financial interests above all other considerations.

The core obligations of fiduciary advisers are multifaceted and comprehensive:

Primary Responsibilities

Providing objective, unbiased financial advice

Conducting thorough investment research

Developing personalised financial strategies

Mitigating potential conflicts of interest

Reporting and Transparency Obligations

Comprehensive fee disclosure

Regular portfolio performance reporting

Full explanation of investment recommendations

Detailed documentation of financial strategies

Fee Structure Variations

Percentage-based management fees

Fixed annual retainer models

Hourly consulting rates

Performance-linked compensation structures

Modern fiduciary relationships demand unprecedented levels of transparency and accountability. Clients now expect not just financial expertise, but a holistic approach that considers their entire economic ecosystem. Advisers must demonstrate continuous value, adapting strategies to changing market conditions while maintaining unwavering commitment to the client’s long-term financial wellness. This requires sophisticated understanding of investment landscapes, regulatory environments, and individual client dynamics.

Risks, Conflicts of Interest, and How to Avoid Them

Navigating potential conflicts of interest represents one of the most challenging aspects of fiduciary relationships. Investment advisers’ fiduciary duties demand absolute commitment to transparency and client welfare, requiring professionals to systematically identify and mitigate potential risks that could compromise their ethical obligations.

Common sources of potential conflicts include:

Financial Compensation Risks

Commission-based recommendation structures

Hidden fee arrangements

Product kickback incentives

Proprietary investment product promotions

Relationship-Based Conflicts

Personal investment relationships

Family business connections

Undisclosed business partnerships

Competing client interests

Technological Disclosure Challenges

Algorithmic bias in investment recommendations

Artificial intelligence decision-making limitations

Data privacy and information management risks

Potential technological recommendation distortions

Fiduciary advisors must proactively disclose potential conflicts and implement robust mitigation strategies. This involves creating transparent communication channels, maintaining comprehensive documentation, and consistently prioritising client interests over personal or institutional financial gains. The most effective advisers transform potential conflicts into opportunities for demonstrating professional integrity and client-centric service.

Discover Trusted Fiduciary Advisers Who Prioritise Your Financial Interests

The role of fiduciary advisers centres on trust, transparency and an unwavering commitment to your financial welfare. If you are navigating complex cross-border investments, seeking personalised wealth management or require clear guidance from verified professionals, avoiding conflicts of interest is critical. Many investors face challenges including unclear fee structures and uncertainty about advisers’ true priorities. Understanding fiduciary duties can transform how you protect and grow your assets globally.

Start your journey with Linkindependent.com where transparency meets expert guidance. Our platform simplifies finding regulated fiduciary advisers who adhere to the highest legal and ethical standards anywhere in the world. You define your needs, get matched with trusted professionals and arrange free consultations that place your interests first. Don’t risk your financial future by settling for less than fiduciary-level care. Visit Linkindependent now and experience wealth planning with integrity, clarity and confidence.

Frequently Asked Questions

What is the role of a fiduciary adviser?

A fiduciary adviser is a financial professional legally obligated to act in the best interests of their clients, prioritising client welfare above their own financial gains.

How do fiduciary advisers differ from standard financial consultants?

Unlike standard financial consultants, fiduciary advisers must operate with complete transparency and prioritize their clients’ financial interests, offering unbiased recommendations without conflicts of interest.

What are the key responsibilities of fiduciary advisers?

Fiduciary advisers are responsible for providing objective financial advice, conducting thorough investment research, developing personalised financial strategies, and ensuring transparency in fee structures.

How can clients identify a fiduciary adviser?

Clients can identify a fiduciary adviser by checking for their fiduciary status, reviewing their qualifications, and inquiring about how they disclose potential conflicts of interest and their compensation structures.

Recommended

Comments